As internal structural changes become the norm due to tightening budgets and the COVID-19 Pandemic, claims executives are looking for technology solutions that enable new operating workflows. These new workflows could include expanding desk adjusting teams, broadening field staff responsibilities to include desk adjusting, or streamlining how low and high severity claims are handled.

Each of these improved workflows require technology solutions that advance the consistent and accurate gathering of claim data across your organization. Technology solutions don’t scale when inconsistency populates claim data sets. Because claim data can come from policyholders, independent adjusting firms, desk adjusting teams, or a carriers’ own field staff, it may have been collected using inconsistent methods and not be standardized. These inconsistencies make it difficult to leverage the data beyond an individual claim.

Technology solutions are already solving these issues and standardizing the claim data collection process, removing data silos by integrating multiple claim data collection, and standardizing varying documentation types from PDF reports, to zipped folders of images, to static measurement reports. Unified data that is both dependable and consistent improves cycle times, lowers LAE while enabling executives to adapt and scale new solutions in a restructured claim organization.

New technologies usher in digitization, automation, and even introduce the variabilization of some costs to your claims organization – all while consolidating the number of vendors you’re dependent on. Claims workflows that were once considered only by futurists and planners on innovation and technology teams are now normal. These new workflows are fueling a boom in technology adoption and workforce changes not even considered twelve months ago.

Digitization 3.0

Digitization 1.0 moved us away from hand–written inspection reports to PDFs of hand-drawn inspection reports. Digitization 2.0 introduced digital capture of damage using phones or claim centric apps that can even be used by homeowners.

“Digitization 3.0 adds the cloud and artificial intelligence.”

Digitization 3.0 adds the cloud, artificial intelligence, and cross collaboration capabilities vertically and horizontally through your claims organizations and beyond.

Digitization 3.0 standardizes inspection workflows and overlays the data with enhancements like machine learning that detects common damage types, such as from wind and hail events. Digitization 3.0 leverages cloud-based systems to instantly make claim data available across the enterprise including auditing, underwriting and actuarial departments. These capabilities allow for the confident analysis of claims remotely and enable modern claims teams to operate at high efficiency.

Cycle times for these workflows can be extremely fast. For example, an obvious hail claim can be documented by a third party using the technology platform assigned by the carrier. Leading platforms are device agnostic and support mobile devices and drones. The data is uploaded to the cloud where damage detection powered by machine learning tools are used to identify damage. A desk adjuster can quickly confirm damage and move the data into an estimation platform. All the data is available in the cloud for future training, auditing and quality control. From start to finish, the entire process from inspection to estimation can be concluded in less than an hour without deploying a field adjuster to the claim.

Consolidating Technology and Service Vendors for Data Consistency

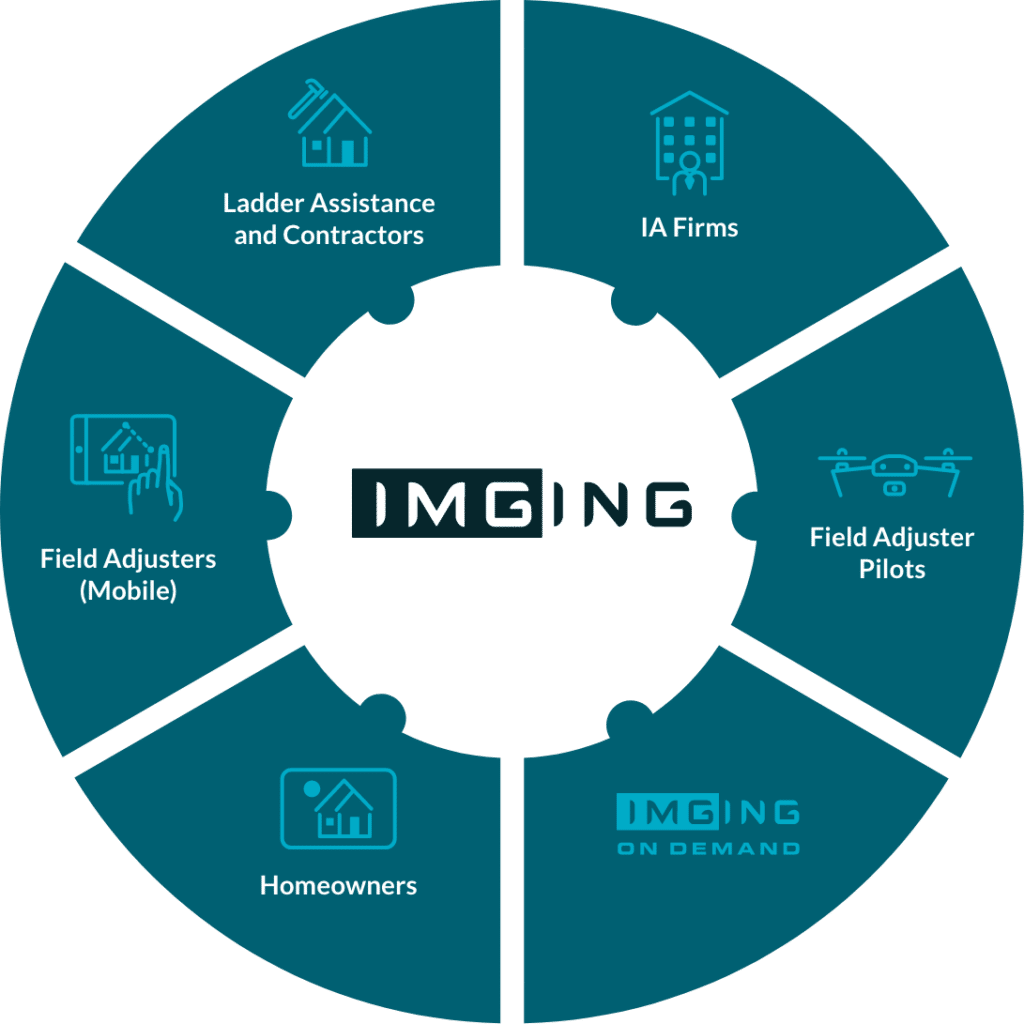

Forward-looking claims executives are looking for solutions that can replace several vendors with one product. This allows them to negotiate better prices for services based on volume consolidation and simplify workflows by centralizing data. For example, a carrier may use a solution for independent adjusting services, homeowner tools for onsite data capture, a different vendor for measurements, and an inspection documentation platform for their field team.

There are now technology vendors that are consolidating technology and vertically integrating onsite inspection tools, measurements, outsourced inspection services, and cloud-based damage detection analytics into one platform. Carriers can choose which of the vertically integrated services they want to operationalize to collapse their vendor stack and negotiate better volume prices. Consolidating tools and vendors to a single platform creates richer data while improving outcomes. Centralizing inspection data in one platform allows for simpler integrations with claims management systems, spreads data availability across an organization, and ensures consistent quality.

Restructuring Claims Teams to Optimize LAE

Carriers prior to Covid19, and now after, have begun rethinking how to restructure their claims teams to achieve optimal efficiency, improve the policy holder experience, and exercise control of LAE. This doesn’t mean carriers are eliminating field staff, it means technology is allowing field staff to be used in new ways. The insurance industry has long demonstrated the benefits of cost variabilization in claims through independent adjusters and ladder assist companies. The realities of the global COVID-19 pandemic are forcing a closer look at which costs must remain fixed, and where costs can become more variable without sacrificing quality.

Contracted, on-demand inspection and claims services aren’t new. So, what is different now that makes this a compelling path to pursue? The answer is new claim-based technology. An inspection platform can automate data capture where possible, and provide streamlined prompts to ensure consistency, all while providing new tools like 3D structure models, geotagged images, and A.I. powered damage detection for deep context unavailable from a PDF report. Technology is the differentiator between a myriad of vendors and streamlined, consistently reliable, outsourced data collection. With on-demand inspections services available nationwide, carriers can respond to more complex claims in new ways without incurring overhead costs when volume is low.

The Full Picture

By adopting the pillars of the future of propriety claims, your claims organization will be best poised to thrive in a climate of constant change. Processes will be streamlined, results consistent, cycle times lowered, and LAE reduced. What’s the next step at making these concepts a reality? Start by partnering with a proven property data and inspection platform such as IMGING from Loveland Innovations To learn more about IMGING please visit our website at https://www.lovelandinnovations.com/insurance/ or ask to speak with an insurance industry specialist by contacting us at insurance@lovelandinnovations.com.