Drones In Insurance Claims

Insurance carriers take a methodical approach to adopting new technologies that alter existing workflows. The COVID-19 pandemic is compressing traditional proof-of-concept trials and phased rollouts and accelerating digital adoption across the P & C insurance sector. The Federal Aviation Administration (FAA) introduced the Part 107 licensing program for commercial flying of drones in 2016. In the years since, the use of drones in insurance went from speculation to exploration, to quick adoption.

As of July 2021, there are over 350,000 commercially licensed drones in the U.S. Whether the initiative lives in an innovation team or with the Director of VP or claims, seemingly every carrier has an executive focused on researching, vetting, building, or managing a drone program for property claims. Drones are keeping adjusters safe on the ground, saving time, centralizing data, or making virtual desk adjusting a reality. But can they make a significant impact on loss adjustment expenses and enable data efficiencies if viewed as a component of a larger property data analytics platform. What is the right strategy for your claims department? Let’s examine popular models of adopting drones in insurance claims starting with the simplest and fastest approach.

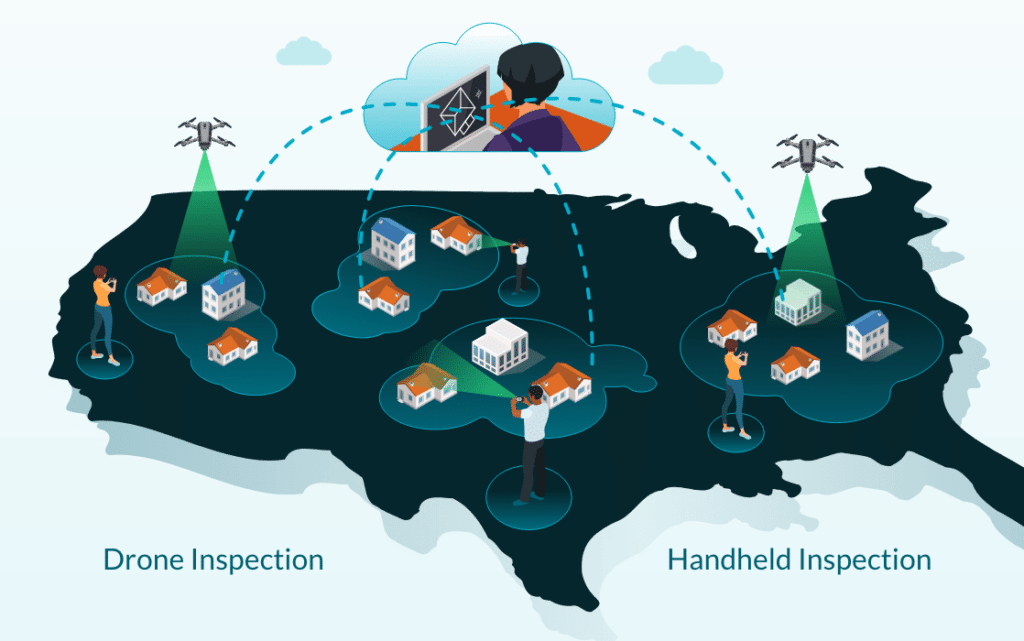

On-Demand Drone Inspections

Carriers without large in-house field adjusting teams may find the simplest path to incorporating drones into their workflows by adopting a drone-based, on-demand inspection service. This enables the rich collection of data analytics that can only come from software like IMGING and isn’t available from traditional inspection services or third-party providers. Rather than a hand-drawn report or a folder of photos, IMGING inspections provide virtual desk adjusters drone imagery, artificial intelligence-powered damage detection, photo-realistic 3D models for context, measurements, annotations, and preliminary inspection reports captured consistently in the cloud. This updated process saves adjusters time by giving them detailed property data without needing to travel to the site of the claim.

Catastrophic Response

The earliest carriers adopting drones began with a targeted approach. MetLife first searched for a drone software solution for their catastrophic (CAT) adjusting team after Hurricane Harvey. By outfitting a traveling CAT team with drone software solutions, the team could work faster and more efficiently during the grueling and intense time following a CAT event. When claims volume is highest after a CAT event, this is an important time to reduce cycle times with technology.

Regional Drone Adjusters

Not all carriers respond to severe weather with a mobile CAT team. For these carriers, a regional drone adjusting model may be appropriate. In this model, we’ve seen carriers take the addresses of insureds, analyze historical weather and claim data, and overlay this with the location of their property adjusters. The adjusters strategically located in areas where there is a high count of policies in force (PIF) and historical weather events are then licensed, outfitted with drone hardware and the leading property inspection software. In addition to covering a traditional geographic area like other adjusters, they travel across a larger than usual territory for steep-and-high roofs or when weather events require.

Complete Claims Data Capture Ecosystem

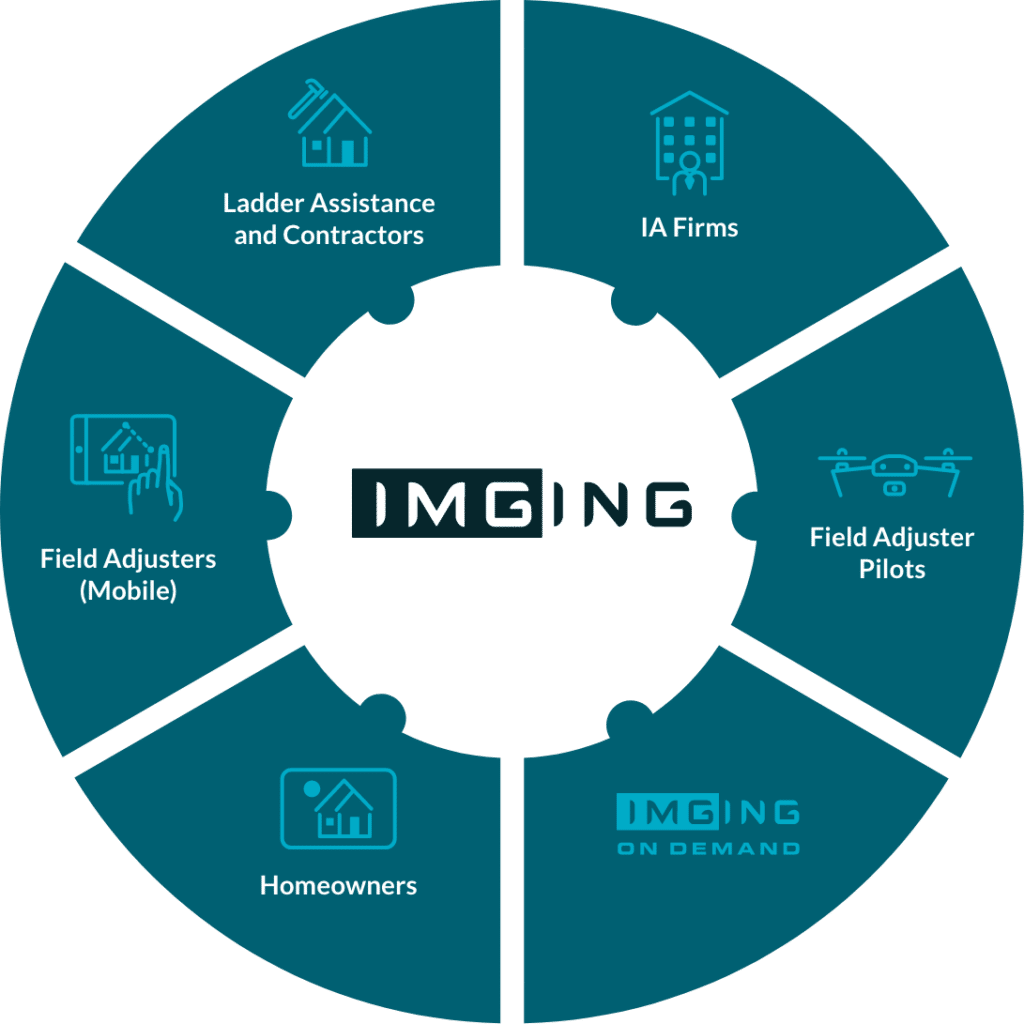

Forward looking carriers are thinking beyond drones as hardware used to capture images from the air. They look at using drones in property claims as one part of an entire ecosystem of claims data capture.

We call this digitization 3.0, the move from hand-written inspection reports, PDFs, and iPhone images to storing data in the cloud, adding artificial intelligence, and vertical and horizontal collaboration enabled only by one standardized central repository for claims data. This approach doesn’t start or stop with drones but views them as one tool in claims data collection, leading platforms are device agnostic and seamlessly support mobile devices and drones.

Centralizing the collection of claims data into one property data analytics platform standardizes methods and creates the consistency in structured data needed for large-scale analysis – enabling business intelligence to glean insights into claims and adjuster operations previously muddied in disparate data files. Unified data that is both dependable and consistent improves cycle times, lowers LAE while enabling executives to adapt and scale new solutions in a restructured claim organization.

Conclusion

Which approach is right for your organization? This will depend on the ratio of in-house versus third-party adjusters, goals for adjuster safety, appetite for innovation that lowers LAE, and a host of other factors. At Loveland Innovations, we bring decades of insurertech expertise to every engagement and can help you find the right model for your organization.

![How to Measure a Roof With a Drone [Updated April 2023]](https://www.lovelandinnovations.com/wp-content/uploads/2024/04/How-to-Measure-a-Roof-With-a-Drone-Updated-April-2023.png)