Insurance technology is leaping forward, and since we released IMGING’s ai-powered damage detection in 2018, we have seen big changes in how insurance companies handle everything from claims to underwriting and even fraud. Technology like automated inspection drones as well as data analytics technologies like artificial intelligence, machine learning and much-sought-after deep learning, have moved from novelties to an essential part of the insurance industry’s toolkit. But what exactly is the difference between these terms? What do these various technologies do and what exactly does that mean for the insurance industry?

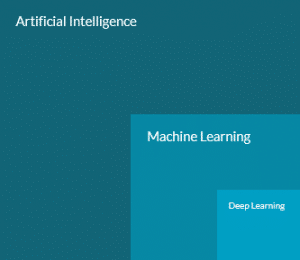

There’s a lot of overlap when it comes to artificial intelligence and machine learning, and they’re often used interchangeably, though they’re not the same.

At its most simple, artificial intelligence is the broader concept – it’s intelligence displayed by a machine. Machine learning is a method of achieving artificial intelligence, and deep learning is an approach to machine learning. One way to describe it is to say that if artificial intelligence is a text-book, machine learning is a chapter in that book, and deep learning is a page or two in that chapter. The diagram below breaks down this concept.

But to understand each concept and how we can apply it to insurance, let’s look closer.

Artificial Intelligence

To put it simply, artificial intelligence is exactly what it sounds like: intelligence demonstrated by a machine. Again, this is the broader concept, but with AI, a machine is carrying out a complex task or calculation and mimicking cognitive thought. A simple example of AI would be a computer playing chess.

Machine Learning

With machine learning, a computer can gather data and use it as part of a larger, digital neural network; a computer can “learn” as it gathers more information. This is the next level of AI, because we’re not just programming a computer to carry out a complex task that appears smart, we’re creating a system where any new data the system gathers actually makes it smarter.

Deep Learning

Deep learning is a specific approach to machine learning. With this approach, artificial intelligence is focused on solving problems. Basically, you’re building a computer system that makes a decision. At its core, deep learning involves providing a computer system with lots of data. Collected together, this data allows the computer to make decisions about other data. And so, you’re giving a computer the ability to interpret patterns and identify “things” (e.g. is this or is this not a hail hit). Deep Learning requires specific systems, workflows, and approaches to allow a computer to make recommendations about data.

What Does This Mean for Insurance?

Tech-jargon aside, what does this new technology mean for the insurance industry? This tech allows a computer system to aid decision making. It’s more consistent, it’s not prone to human error or fatigue — that is to say, it always performs at its best. These technologies can sift through much more data, much more quickly than any human, and even come to a conclusion about the data. Carriers are already saving hundreds of minutes a year searching for damage per adjuster by using ai-powered damage detection technology.

An example of deep learning used in the insurance space today is our data capture and analysis tool IMGING. IMGING uses a combination of computer vision (which is essentially a series of cameras and sensors mounted on a drone, as well as the associated meta data like altitude, compass headings, GPS tags, and gimbal angles) and deep learning to help identify hail hits and missing shingles for composition roofs.

Where Deep Learning is Headed

What we’re doing with IMGING now is just the start of something huge. Other uses of deep learning and computer vision include automatically identifying risks on a property for underwriting, or determining with a high degree of confidence that a hail hit isn’t a hail hit, but in fact a smack from a ball-peen hammer. It’s not enough to know there’s damage, IMGING is built to tell you what caused it.

The foundational deep learning tech we’ve built positions us as the only player in the market that can grow and evolve deep learning technology at such incredible speeds – we’re not bragging when we say we’re completely redefining insurance. With deep learning, computer vision, and a future involving the latest in estimatics, we see a world where the entire insurance workflow improves from top to bottom.

![How to Measure a Roof With a Drone [Updated April 2023]](https://www.lovelandinnovations.com/wp-content/uploads/2024/04/How-to-Measure-a-Roof-With-a-Drone-Updated-April-2023.png)