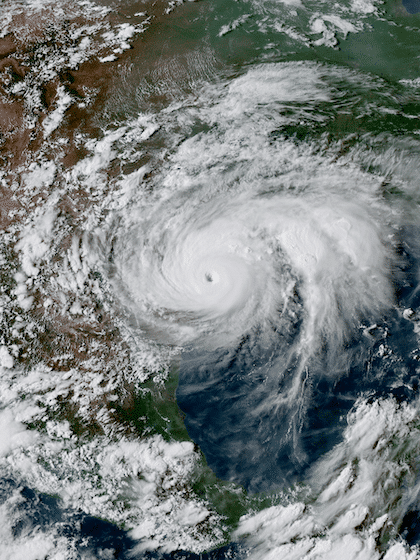

Storm season is always demanding for insurance carriers. But 2017 was something unique.

In August of that year, Hurricane Harvey formed in the Atlantic. Its power peaked as it made landfall in Southern Texas, displacing tens of thousands while leaving devastation in its wake.

In the aftermath of one of the costliest tropical storms in history, MetLife realized they must drastically change their approach to claims to serve policyholders in the face of increasingly powerful storms, or they—and their policyholders—would suffer the consequences.

Finding the Future of InsurTech

MetLife had a few goals as they set about assessing new technologies to help. Stronger storms mean more claims, more damage, and more pressure on adjusting teams to process those claims quickly. To give policyholders the best possible experience, MetLife needed new ways to drastically improve adjuster efficiency and find ways to reduce loss adjustment expenses.

Their search for new technologies eventually led them to property data analytics pros, Loveland Innovations.

Loveland Innovations was founded by InsurTech veteran, Jim Loveland, the former President and CEO of Xactware. Jim brought together a crack team of AI experts, data scientists, and claims professionals to develop the most sophisticated property analytics solutions in the industry. To help MetLife reach these goals, the team at Loveland Innovations helped MetLife adjusters redefine their approach to claim inspections with an advanced platform called IMGING.

Rearchitecting the Claims Process

Loveland trained MetLife’s team of adjusters in person and walked them through all the ways the IMGING platform can automate portions of the claims process. With IMGING, MetLife has a platform that allows them to safely gather claim data with automated drones, analyze it using powerful artificial intelligence, and benefit from new ways to manage adjuster resources across the country.

Throughout the partnership, MetLife’s claim team brought new ideas to Loveland’s drone and AI experts. Drawing from MetLife’s real-world usage in the field, Loveland built even more functionality into their platform to tailor it perfectly to the unique demands of large insurance carriers.

Adjusters using IMGING can fly residential properties in as little as ten minutes, get measurements and even use automated damage detection while they’re still on-site. Back in the office, adjusters can navigate and measure photo-realistic 3D models, view imagery, and create thorough reports to adjust entire claims in a virtual workspace. This updated process saves adjusters time, while also giving them a way to interact with property data without being on-site.

Today, MetLife is using IMGING across its adjusting force. Adjusters in the field are reporting more efficiency and more safety as they assess wind and hail-related damage claims. As an organization, MetLife gained an edge in handling large catastrophic events since they can more easily allocate adjuster resources and ensure quick claim settlements.

Getting More From IMGING Property Data

For MetLife, this is just the beginning. They plan to continue using IMGING as part of their drone and analytics strategy and will put the platform in the hands of dozens of adjusters, so they can reap all the benefits on a large scale.

From mid-tier carriers to AM Best’s top writers, carriers across the country are reducing LAE by putting IMGING in the hands of field adjusters. With carrier challenges continuing to grow, the elite among them will find innovative ways to bring a high-caliber experience to their policyholders, even in the face of the massive storms of tomorrow.

For more information on how Loveland Innovations is helping carriers rearchitect the claims process, sign up for a demo or visit this page.

![How to Measure a Roof With a Drone [Updated April 2023]](https://www.lovelandinnovations.com/wp-content/uploads/2024/04/How-to-Measure-a-Roof-With-a-Drone-Updated-April-2023.png)